|

One of the first steps to choosing the right manager for your wealth is knowing the right questions to ask. And knowing the right answers to see if they measure up to your financial goals. How long have you worked with high-net-worth individuals, and in what capacities? Although private wealth advisers often find working with high-net-worth investors to be satisfying, other career paths can offer insights about the technical knowledge required for client success. What training did you undertake to prepare for this role? Some larger firms offer specialized training courses, while practitioners elsewhere may enroll in classes or degree programs to prepare themselves. Have you earned any relevant professional credentials? There are many, many professional designations that private wealth advisers can attain. Inquire about the breadth of curriculum, hours of preparation required, and pass rates to determine how substantive each program might be. Describe any conflicts of interest that could exist between us, and how you would propose to address or manage them. Would you certify that you are acting as a fiduciary on my behalf at all times? While some business models may not permit an adviser to act as a fiduciary on your behalf (that is, someone who always puts your best interests ahead of any others, including their own or their employer’s), you should note how conflicts of interest are managed and mitigated. Have you ever been subject to any allegations of misconduct or disciplinary actions from a regulatory body? Details about disciplinary actions may be available on regulator websites, but advisers should also discuss allegations with you that did not result in disciplinary actions. Refer to the SEC’s guide https://www.sec.gov/reports pubs/investor-publications/investor-brokershtm.html for more information. Of the many dimensions of a wealth management offering (e.g. investment management, financial planning, behavioral coaching, financial concierge, family dynamics coaching) which do you think are your particular strengths and/or areas of emphasis? How do you work with external advisers? It is unlikely that any single professional can be an expert in all aspects of wealth management. Consider how your adviser addresses the dimensions of wealth management outside of their core expertise, as well as how they could work with any other existing advisers you currently have and like. Describe any conflicts of interest that could exist between us, and how you would propose to address or manage them. Would you certify that you are acting as a fiduciary on my behalf at all times? While some business models may not permit an adviser to act as a fiduciary on your behalf (that is, someone who always puts your best interests ahead of any others, including their own or their employer’s), you should note how conflicts of interest are managed and mitigated. What do you think your specific added value is, and how would I recognize that in our relationship? Your adviser’s answers should align well with your needs and be realistic and appropriate. Beware of unrealistic claims of potential performance or discussion of services that you don’t expect to be of interest to you. Is management of my wealth more about “winning” or “not losing?” How is that reflected in what you do for me? The most appropriate answer in many cases will involve some elements of both winning and not losing, but pay attention to how your adviser describes their philosophy and the tactics that reflect their approach. Consider how your appetite for risk fits with your adviser’s approach being sure to remember that returns without risk are unrealistic. What is your approach to investment management? Do you prefer a particular investing style? Do you prefer particular investment vehicles? Your adviser should be able to explain why they choose to execute their investment strategy in the way they do, and will often reflect priorities for diversification, expense control, tax management, or liquidity. Consider how your adviser has regarded more recent innovations in the marketplace to assure yourself that they bring fresh perspective to their strategy. Describe your proposed fee schedule. How does your fee schedule align with achieving my goals? Many advisers will assess a fee based on the market value of assets they manage on your behalf, which aligns with your interests to the extent that successfully growing assets within agreed upon risk parameters is to your benefit. Discuss with your adviser how such fee arrangements might affect their advice that would cause the level of assets under management to decline (for example, to buy investment real estate) as well as how growth in assets would affect the marginal cost of their advising services. What other expenses would I expect to incur as part of our relationship? To properly understand the cost of advice and make your adviser’s fees easily comparable to others, consider any additional fees that may apply including fees for financial planning, financial concierge services, custody, or other expenses. Download the PDF below for even more important questions to ask.

1 Comment

The pace with which the Coronavirus bear toppled the longest-running bull market in history was startling. The Dow Jones Industrial Average officially entered the “Coronavirus bear market” in just 20 trading days, easily making it the fastest such slide in stock market history. The second fastest was 1929 and that took 36 trading days.

Lest we forget: the highest closing record for the DJIA was set on February 12, 2020, when it closed at 29,551.42. Less than one month later, on March 11th, the DJIA closed at 23,553.22, down 20.3% from its high and officially ending the longest-running bull market in history that started in March 2009. Bear Market Defined In technical terms, the stock market enters a bear market whenever stock prices have fallen over 20% from their recent peaks. A bull market, on the other hand, is when stock prices rise by at least 20%. There is debate as to where the true origins of these expressions came from, but many suggest that it has to do with how each animal attacks: a bull thrusts its horns and enemies upward whereas a bear swipes its paws and enemies downward. Neither sound pleasant. In fact, an examination of the historical performance of the S&P 500 from 1926 through March 2020 shows that:

The silver lining is that bear markets are shorter than bull markets. Stock Market Corrections & Crashes It is important to distinguish a bear market from a market correction, which is shorter and involves less of a market decline. Market corrections are short-term trends that typically last less than a few months and involve stock market declines of at least 10% – but not as severe as the 20% fall of a bear market. Stock market crashes, by contrast, are when stock markets plummet by more than 10% in a single day. The Great Crash of 1929 consisted of market drops of 13% and 12% on successive days. The stock market crash of October 19, 1987 – known as Black Monday – saw the market drop 23%. And on March 16, 2020, the market crashed when it dropped 13%. Historical Bear Markets Between 1926 and March 2020 There have been eight bear markets, ranging in length from about 6 – 24 months and bringing market declines ranging from more than -80% to just over -20%. Here are the more memorable bear markets.

The upside of a Bear Market The one great thing about Bear Markets, is they end. And almost more importantly they make way for a new Bull Market. Consider the rallies that occurred during a few of the past bear markets:

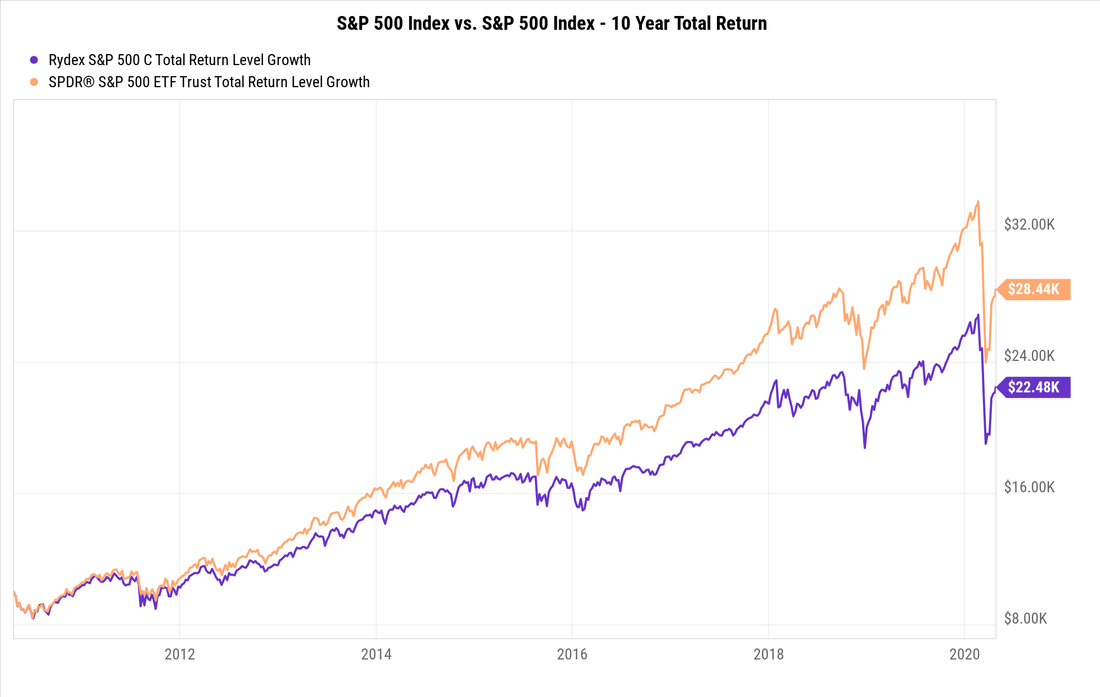

Thoughts for Investors The question is, should the average investor remain invested when a bear market starts swiping its paws and everything downward? While the answer to that question depends on the individual investor, it is important to beware of the tendency to over-react to fears of a bear market or thrills of a bull market. Often times, individual investors tend to let their emotions adjust their holdings, which can result in selling after prices have fallen sharply, instead of buying at low prices (or buying after stocks have risen to unsustainable heights). Whether you will be able to out-wait the Coronavirus bear market and rebuild your portfolio to your satisfaction depends upon a deluge of factors, including the duration of the Coronavirus bear, your risk tolerance, your time to invest, the strength of your investments and the choices you make going forward. What's the difference between these two S&P 500 index funds? They both track the same index. They invest in exactly the same companies. They both are passively managed. So what might cause their dramatic difference in performance over the last decade? Simply, the amount of money they charge investors. The industry calls this fee their "expense ratio." If you had invested $100,000 in the most expensive S&P 500 index fund 10-years ago vs. the investing in one of the lowest cost S&P 500 index fund 10-years ago, you'd have $60,000 less. Let that sink in. $60,000 LESS. Again, these funds invest in the exact same companies. You simply paid more money for investing in the exact same companies, and in the end, the fund company kept more money and you earned less. Fees matter. Many investors and for that matter many Financial Advisors don't understand what they are actually investing in when they pick a particular investment fund. Many unsuspecting investors look at the name of the fund, do a quick glance at the historical performance and hit the "buy" button without fully vetting what the fund is actually invested in. For many investors the process I just laid out is what they call "research", but in truth it's nothing more than window shopping.

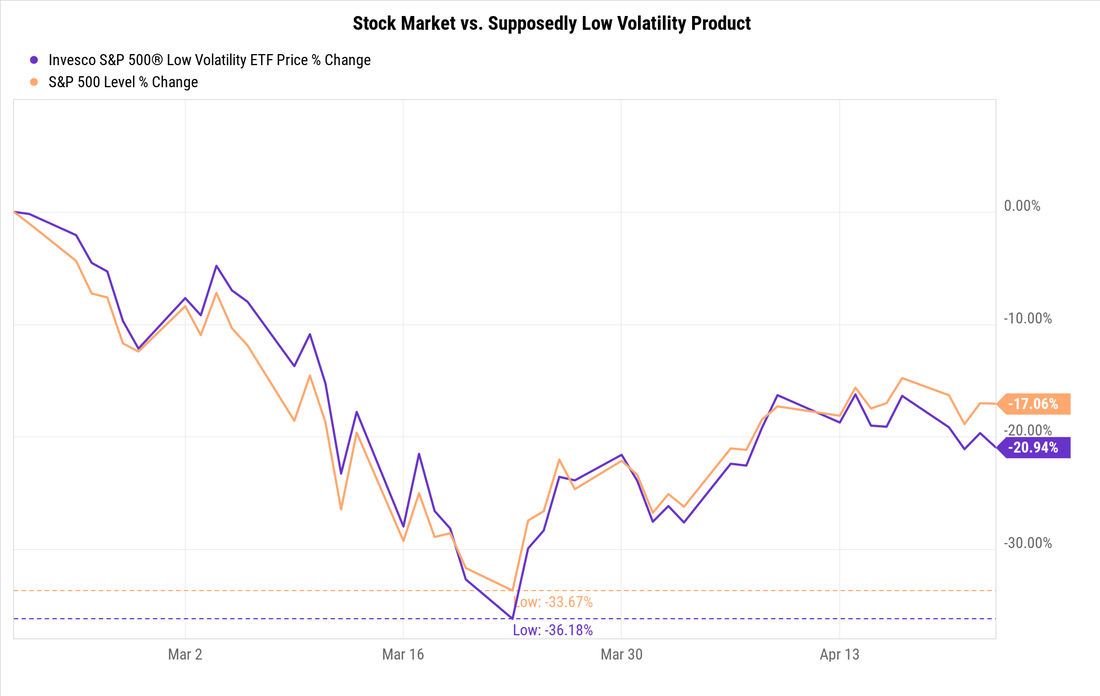

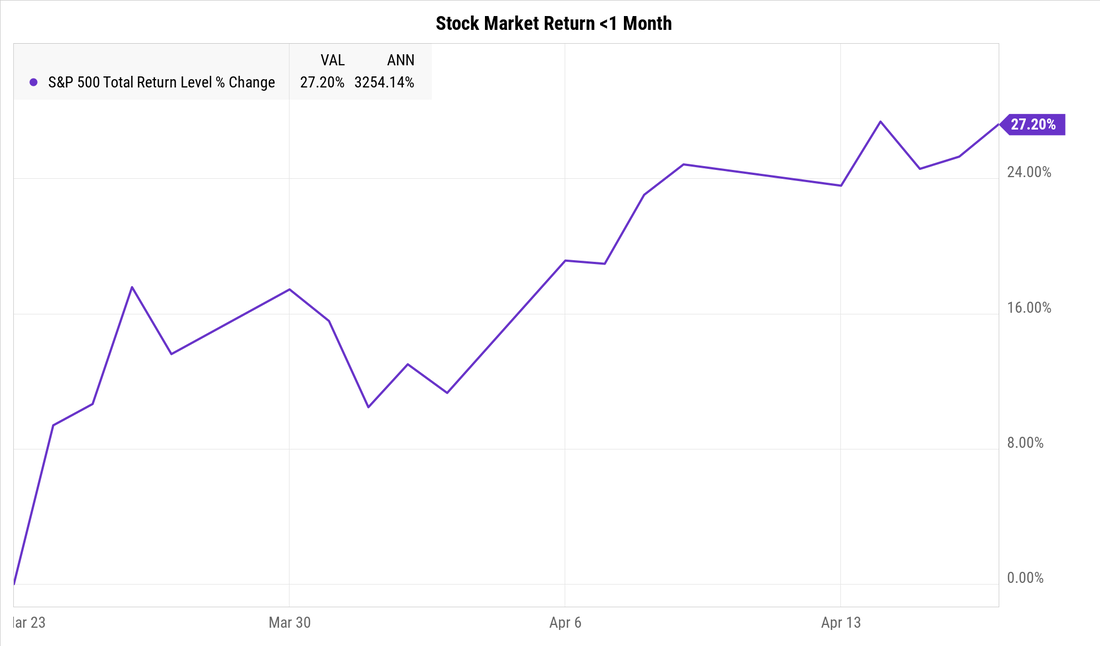

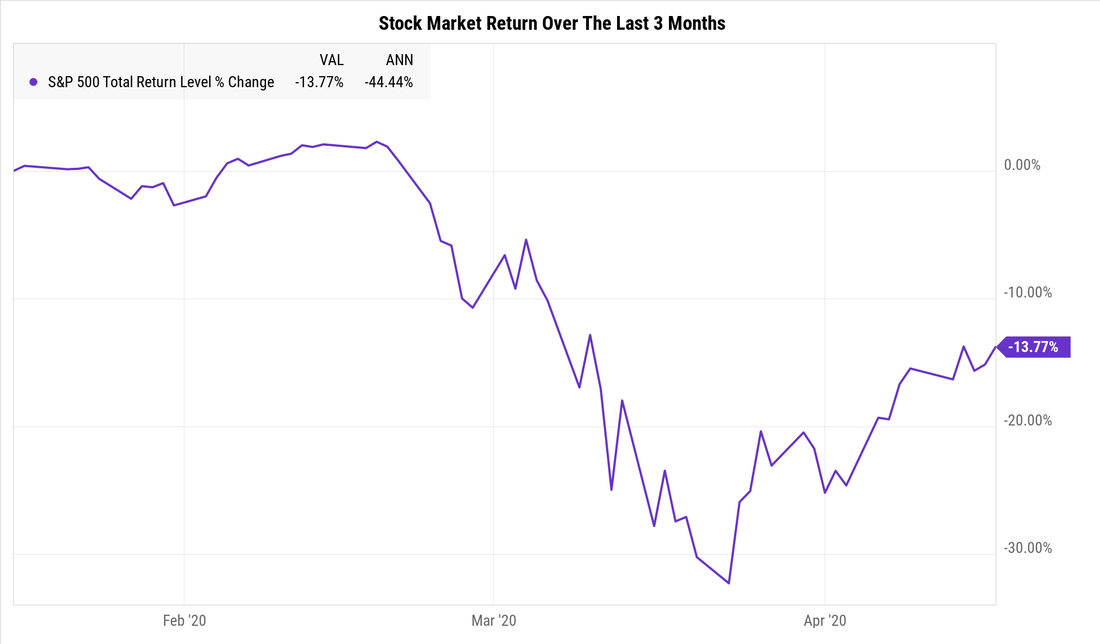

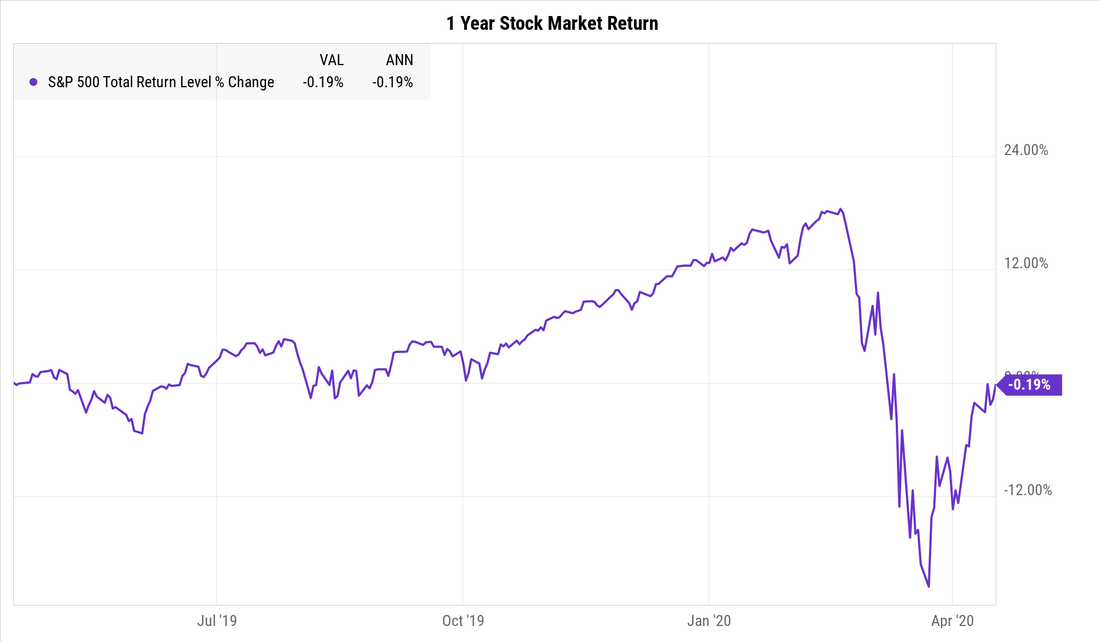

Buyer beware. Take a look at the chart below of a fund that claims to be a "Low Volatility" fund...meaning, the goal of this fund is to be LESS risky than the market. This didn't work out so well for this fund and its investors. This particular fund has been actually MORE risky. Deep due diligence is required of all investments that are under consideration to be put into a portfolio to adequately understand the risks and the potential returns. Looking beyond the name of the investment is just the first step. Depending on the time frame you are referencing, the Stock Market return has been great, horrible or something in between. It's important to understand, time can be considered a diversifier similar to diversifying across different assets and securities. Being invested across many different types of securities and across several asset classes is akin to using time to reduce risk, risk goes down with time. It's important to keep Stock Market returns and Time in perspective. In less than a month the Stock Market is up over 27% from the recent bottom. Over the last 3 months the Stock Market is down about -13% Over the last year the Stock Market is essentially flat. The Stock Market is up almost 50% in the last 5 years. In 10 years the Stock Market is up over 190%.

“The worst thing mistake you can make in investing is to buy or sell based on current headlines.” - Warren Buffett During these challenging times, it's actually a great opportunity to review your Retirement Portfolio and your overall Financial Plan. There are some amazing opportunities to take advantage of what the market is providing long-term investors. With more people working from home right now, you might have some extra time to dig up a recent statement and make sure you are on track to meet your financial goals. Here are 8 quick ideas to help improve your Retirement Portfolio. 1. Have Clear Investment Goals The adage, “If you don’t know where you are going, you will probably end up somewhere else,” is as true of investing as anything else. Everything from the investment plan, to the strategies used, the portfolio design, and even the individual securities can be configured with your life objectives in mind. Avoid focusing on the latest investment fad or on maximizing short-term investment return, instead design an investment portfolio that has a high probability of achieving your long-term investment objectives. 2. Focus on the Right Kind of Performance There are two timeframes that are important to keep in mind: the short-term and everything else. If you are a long-term investor, speculating on performance in the short-term can be a recipe for disaster because it can make you second guess your strategy and motivate short-term portfolio modifications. But looking past near term chatter to the factors that drive long-term performance is paramount. If you find yourself looking short-term, refocus. 3. Diversify The only way to create a portfolio that has the potential to provide appropriate levels of return and risk in various market scenarios is adequate diversification. Often investors think they can maximize returns by taking a large investment exposure in one security or sector. But when the market moves against such a concentrated position, it can be disastrous. 4. Know What You Own Far too many investors don’t know what they are invested in. Not knowing what the specific risks of the investment are and not understanding how it does or doesn’t fit into their portfolio. Every investment should have a reason why it’s in your portfolio. Ensure that every investment in your portfolio has a reason to be there. 5. Control What You Can No one can predict the future, but you can take action to shape it! Similarly, you can’t control what the market will do, but you can control how you react to it. Right now the market is offering some great opportunities, use the market’s volatility to your advantage. 6. Reduce Your Media Consumption There are plenty of 24-hour news channels that make money by showing “tradable” information. The key is to parse valuable information out of all the noise. Successful and seasoned investors gather information from several independent sources and conduct their own proprietary research and analysis. Using the news as a sole source of investment analysis is a common investor mistake because by the time the information has become public, it has already been factored into market pricing. A focus on near-term returns leads to investing in the latest investment craze or fad or investing in the assets or investment strategies that were effective in the near past. Either way, once an investment has become popular and gained the public’s attention, it becomes more difficult to have an edge in determining its value. 7. Don’t Try to be a Market Timing Genius Market timing is next to impossible. For people who are not well trained, trying to make a well-timed call can be their undoing. An investor that was out of the market during the top 10 trading days for the S&P 500 Index from 1993 to 2013 would have achieved a 5.4% annualized return instead of 9.2% by staying invested. This difference suggests that you are better off contributing consistently to your investment portfolio rather than trying to trade in and out in an attempt to time the market. 8. Review Investments & Rebalance If you are invested in a diversified portfolio, there is an excellent chance that some things will go up while others go down. At the end of a quarter or a year, the portfolio you built with careful planning will start to look quite different. Check in regularly and rebalance to make sure that your investments still make sense for your situation. Download the 1-page PDF below

When weather forecasts are inaccurate, we can usually change our plans with little consequence in the greater scheme of things. While making financial decisions does involve some guesswork, an educated guess—even with elements of uncertainty—sometimes can be better than making a decision with no forecast at all. Unfortunately, economic forecasting, like weather forecasting, is far from an exact science. Even professional economists may strongly disagree on the direction of the economy at any given point in time, based on their interpretations of conflicting economic indicators. Although many factors are pivotal in assessing the economy, let’s focus on two key points that may help you better understand the economy, and where it may be headed in the near future. 1. Consumer Spending: Since consumer spending has historically accounted for about two-thirds of the economy, according to the U.S. Bureau of Economic Analysis. Consumer cutbacks on spending are not usually the primary cause of a recession. Rather, consumers may buy more on credit, which leads to greater monthly payments. But at some point, consumers can spend only what their incomes will allow. When consumer debt rises, it becomes particularly important because of the impact of total consumer spending on our economy. It may also be helpful to understand the Federal decisions that lay the foundation for our overall economic climate. 2. U.S Government (Monetary & Fiscal Policy): The Role of the Federal Reserve Bank (the Fed) Even the casual observer of business news knows that “Fed watching” is a serious activity in the financial and business sectors. You may be wondering, what it is that makes the Fed so important. While consumers can affect the economy by spending according to their own situations and financial pressures, Federal policy decisions, such as fiscal and monetary measures, also have an effect on the economy. Fiscal policy, enacted by Congress in the form of tax and/or spending legislation, is the result of the political process and the prevailing political climate. In contrast, monetary policy is the responsibility of the Fed, whose role is to evaluate all factors influencing the economy (individual, market, and government) and take action in attempts to keep the economy on an even keel. The Fed can manipulate the flow of money in order to obtain a desired effect over time. However, the Fed’s most effective short-term policy decisions that can manipulate the economy involve short-term interest rates. Consequently, the Fed can realistically have only one target: inflation. If the Fed perceives that prevailing forces will increase inflation, it can attempt to slow the economy by raising short-term interest rates. It does this based on the assumption that an increase in the cost of borrowing is likely to dampen both personal and business spending. Conversely, if the Fed perceives that the economy has slowed too much, it can attempt to stimulate growth by lowering short-term interest rates, the theory being that lower costs for borrowing may stimulate more spending. The Fed walks a fine line in trying to maintain this balancing act. If it doesn’t tighten the reins soon enough by raising interest rates, it runs the risk of uncontrolled inflation. If it fails to loosen them soon enough by lowering interest rates, the economy could plunge into a recession. An argument could be made that the primary goal of the Fed is to keep inflation low enough that it does not affect business decisions. You & Your Financial Plan: Your own personal financial plan is really what will drive your success (or failure). By understanding what your goals are, where you are today and having a well-thought out plan to get you from where you are today to where you want to go is ultimately what's important. Understanding how the markets work, who the participants are, and realizing that many things are unknowable at the time you have to make a decision are extremely important. And it's this last part that is most important, knowing that you won't know everything you'd like to know beforehand is the hardest idea to grapple with. As the well known Nike saying goes, "Just Do It." Many times when you don't know what to do, it's wise to take advice from people who are experts in their respective fields and have been extremely successful. When things seem unsettled, these 3 savants offer timeless advice for investors. Such words of wisdom are especially appropriate amid the current turbulent circumstances: Stocks recently hitting lows and experiencing extreme volatility - to say the least. The variables change, but inevitably crises and problems occur and affect markets like they are today. But most importantly we ALWAYS overcome them. Here’s some food for thought from three great investors to help avoid investment mistakes: Crises in markets come and go: Shelby M.C. Davis. A legendary mutual fund manager. Human history is the history of crises and relative periods of calm. It’s no surprise that markets exhibit the same patterns of exuberance, fear and everything in between. Every crisis seems to have different origins, whether stagflation or inflation, collapsing or soaring energy prices, falling or climbing home prices. A wise investor acknowledges that crises ebb and flow, and that the best investment strategy adjusts to changes but avoids drastic over-reactions. As Davis puts it: “Crises are painful and difficult, but they are also an inevitable part of any long-term investor’s journey. Investors who bear this in mind may be less likely to react emotionally, more likely to stay the course, and be better positioned to benefit from the long-term growth potential of stocks.” Don’t let your gut emotions steer investment decisions: Benjamin Graham. Graham is considered the father of value investing, he taught Warren Buffett and wrote a number of classic books on investing. Graham said: “Individuals who cannot master their emotions are ill-suited to profit from the investment process.” Avoid market timing: Peter Lynch. He rose to fame by successfully managing the Fidelity Magellan fund from 1977 to 1990, racking up an eye-popping 29% annual rate of return. Sadly, the average investor in his fund during those 13 years earned a small fraction of 29% by jumping in and out of Magellan to try to enhance returns. Lynch once summed up his dim view of market timing this way: “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves." Another example of market timing’s weakness: The Standard & Poor’s 500 from 1992 to 2012 registered a nice 8.2% annual return. What kind of return did investors earn if they missed the best 10, 30, 60 or 90 trading days during those two decades, which is about 2,500 trading days? Investors who missed the best 10 S&P 500 days earned half as much, 4.5% annually those who missed the best 30 days realized zero the best 60 days, negative 5.3% the best 90 days, a whopping minus 9.4%. In other words, stay at a party from start to finish - don’t dart in and out if you don’t like the music or find the conversation boring. The lessons provided by these three investment sages is that your own mistakes may be a bigger source of your own poor return than economic and political factors that move markets and are beyond your individual control. |

||||||||||||||||||