|

Who is Charlie Munger? By many accounts he is a big reason why Warren Buffett has been so successful. Charlie Munger is Warren Buffett’s partner at Berkshire Hathaway. Ironically, he grew up right down the road from Warren Buffett in Omaha Nebraska, although they didn’t know each other growing up. Charlie graduated from Harvard Law School and started his career as an attorney, however, he realized early on that it wasn’t a profession he wanted to continue with, so he started investing and developing real estate which eventually led him to meeting his future business partner. Together, what Charlie and Warren have built over their extraordinary 60 plus years together could be considered similar to what Mick and Keith or Paul and John where able to do; these extraordinary partnerships were able to capture lightning in a bottle. Howard Buffett, Warren's eldest son, has said that his father is the second smartest man he knows. He says Charles Munger is the first. Like Warren Buffett, Charlie's thoughts on business and life are timeless nuggets of wisdom. Here are some of my favorite Charlie Munger quotes

With Charlie's thoughts above, I hope I've helped you know more. -Paul R. Rossi, CFA

0 Comments

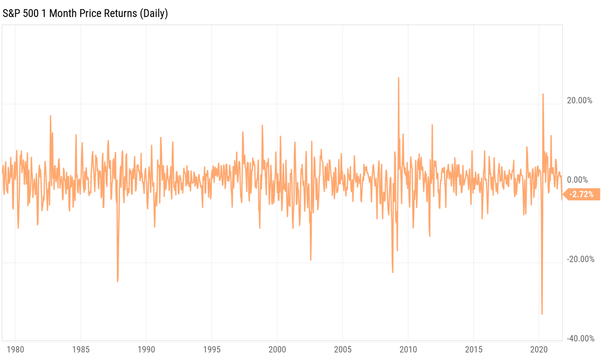

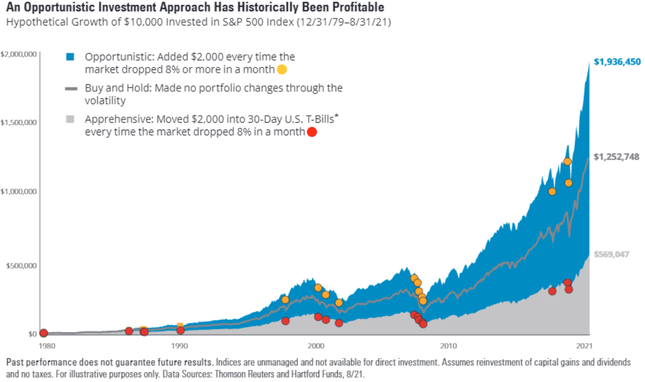

A downturn could actually be good news for you – if you stay calm, stick to a well-designed plan and possibly take decisive action. It’s not uncommon for people to feel a nervous when they hear news about the stock market being down. This nervousness can be exacerbated when someone in the media forecasts a doomsday type of future for the stock market. It’s happened so many times I honestly cannot remember them all. Don't just don't sell just because others are selling, if you sell your stocks after they drop in value you may end up in worse shape than if you stayed invested. When you look at monthly returns for the stock market it appears to be quite volatile but viewed over a longer period of time the market appears relatively tranquil. Having a long-term perspective may not be exciting but it has historically been an effective strategy...and made quite a few people wealthy. Below is the 1-month price return on the stock market going back to 1979. No doubt about it, the stock market has been quite volatile. I don't see that changing anytime soon. Rather than trying to time the market, smart investors focus on time IN the market, allowing their investment returns to compound year after year. The greatest investor of all time Warren Buffett as said, “Be greedy when others are fearful.” Back in 2014 during a market downturn, he said, “The more the market goes down the more I like to buy.” Like Warren Buffett, savvy investors take advantage of market volatility by buying quality stocks when there is a sell-off. In 2013, Warren Buffett gave a great example, he said, "It should be an enormous advantage for investors in stocks to have those wildly fluctuating valuations placed on their holdings—and for some investors, it is. After all, if a moody fellow with a farm bordering my property yelled out a price every day to me at which he would either buy my farm or sell me his—and those prices varied widely over short periods of time depending on his mental state—how in the world could I be other than benefited by his erratic behavior? If his daily shout-out was ridiculously low, and I had some spare cash, I would buy his farm." Similar to having a shopping list prepared before you leave your home for your favorite store; have a list of quality companies that you’d like to own when they go on sale. Buying stocks when they attractively priced could help enhance the long-term growth potential of your portfolio. For those investors who not only didn't sell during market volatility but actually purchased, these savvy investors ended up with more than 3x as much money. See the chart below. So what is the moral of the story? It can pay handsomely to zig when most others are zagging. -Paul R. Rossi, CFA |

||||||