|

In the short-term the markets trade on greed and fear, but in the medium to long-term, they trade on First Principles.

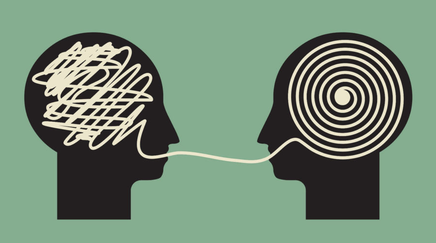

What are First Principles? Before we get to that, let us understand what greed and fear are as it relates to investing. Greed is the idea of not wanting to lose out on an opportunity to make money especially when you see others around you making what seems like easy money. As Warren Buffett said, “Long ago Sir Isaac Newton gave us three laws of motion which were the work of genius, but Sir Isaac Newton's talents didn't extend to investing: He lost a bundle in the South Sea Bubble explaining later, ‘I can calculate the movement of the stars but not the madness of men.’ If he had not been traumatized by this loss Sir Isaac might well have gone on to discover the 4th law of motion for investors as-a-whole returns decrease as motion increases.” Sir Isaac lost millions in today’s dollar equivalent by falling into the greed trap by seeing others around him making seemingly easy money on what amounted to nothing more than a house-of-cards. It didn’t end well for him. Greed is dangerous. On the other side of greed is fear. “Fear is an emotion induced by perceived danger or threat, which causes physiological changes and ultimately behavioral changes, such as fleeing, hiding, or freezing from perceived traumatic events. Fear in human beings may occur in response to a certain stimulus occurring in the present, or in anticipation or expectation of a future threat perceived as a risk to oneself. The fear response arises from the perception of danger leading to confrontation with or escape from/avoiding the threat, which in extreme cases of fear can be a freeze response or paralysis.” – Google search and definition. Interestingly enough, fear like greed can be immeasurably harmful. This can happen by taking action when doing nothing is the right thing or conversely by freezing-up and not taking action when you should. Fundamentally this comes down to rationality. The more rational you can become, the more successful as an investor you can become. How do we reduce our level of fear and strive to be more rational? By taking a step back from the situation and thinking about what’s happening and asking ourselves a series of questions.

While there are many more questions that can and should be asked prior to determining what the right course of action is, you can see that self-reflection and having a deeper understanding of the situation is paramount during times of heightened uncertainly. What is critically important is getting to a deeper understanding of the situation, what is called getting to the “First Principles”. What are First Principles? First Principles thinking is a process by which a person seeks to break down a problem to its simplest elements to find a solution. The first-principles approach has deep roots, in fact, it was a process credited to Aristotle. Over 2300 years ago, Aristotle said that a first principle is the ‘first basis from which a thing is known’ and that pursuing First Principles is the key to doing any sort of systemic inquiry. Quite simply, First Principles is the most fundamental idea which makes it the highest in importance when trying to understand a particular subject. So, what are First Principles in terms of investing? First Principles idea in investing is the understanding of ‘valuation’ and how to value an asset. Ironically, the concept is quite simple: The value of any income producing asset is the present value of its future cash flows. What does this mean? It means taking all the projected future cash flows that a company will generate in the future and discounting these cash flows to the present value using an appropriate discount rate. When you do the math, you find that the vast majority of a company’s value is wrapped up in the future years’ cash flow and not in this year or even next years’ cash flow. Click here to see an example. Investing First Principles: A company’s intrinsic value is based on its long-term cash flows that will be generated far into the future. Greed and fear will always be a part of the market. Volatility isn’t going away. What’s most important is understanding the First Principles approach to the market and realizing that individual companies and subsequently stock markets are valued on their long-term cash flow generating ability. Everything else is greed and fear. -Paul R. Rossi, CFA

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |