|

Target Date Funds have become wildly popular in retirement plans over the last few years, and rightfully so, they help investors who don’t necessarily have a great understanding of investing or don’t have the time, the commitment, nor the energy to put toward researching and understanding how they should be invested. What is a Target Date Fund? It's a prebuilt portfolio that uses one input to determine how to invest your money. What's the one input? The date you expect or plan to retire. That's it. Is this really the best way to plan for your retirement? Probably not, but it's better than having your retirement money sitting in cash or your retirement plan's money market option. Long-term, cash and cash-like investments actually lose their value or purchasing power due to inflation (read here about inflation), so it's important to get your money invested. So Target Date Funds can help people get started in their journey to financial independence if they aren't sure what to do and want to get their feet wet investing. However, to have the highest probably of financial success, the following questions should be addressed and understood prior to making any investment decisions:

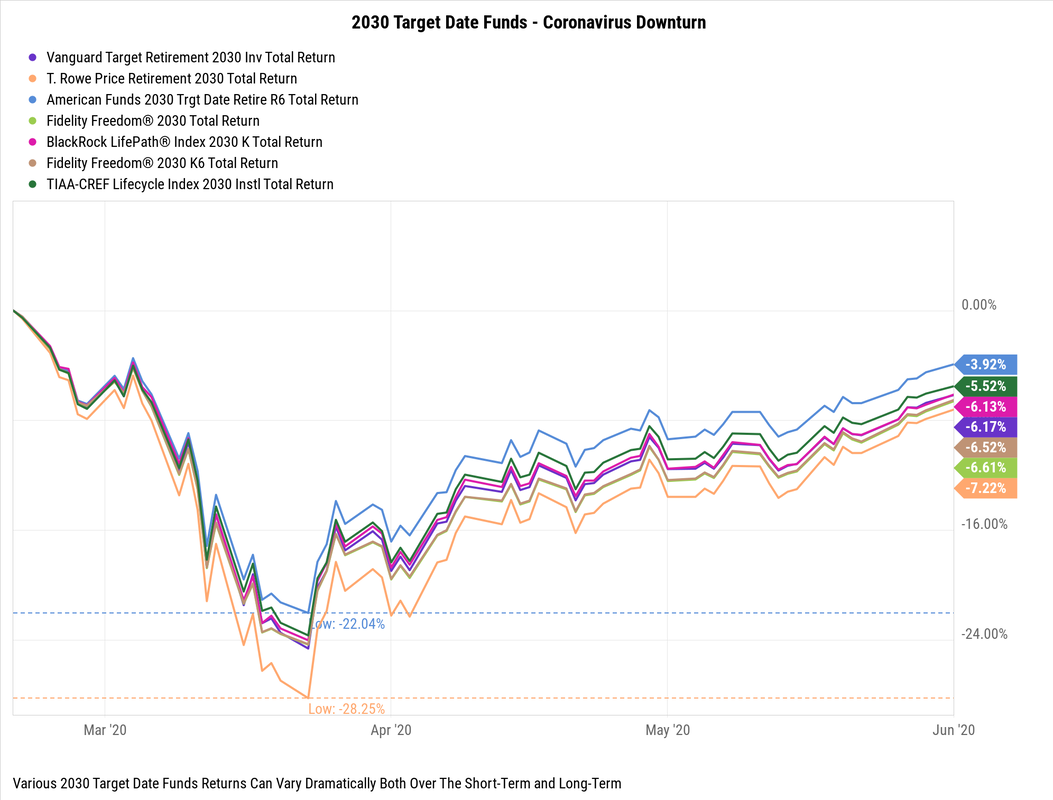

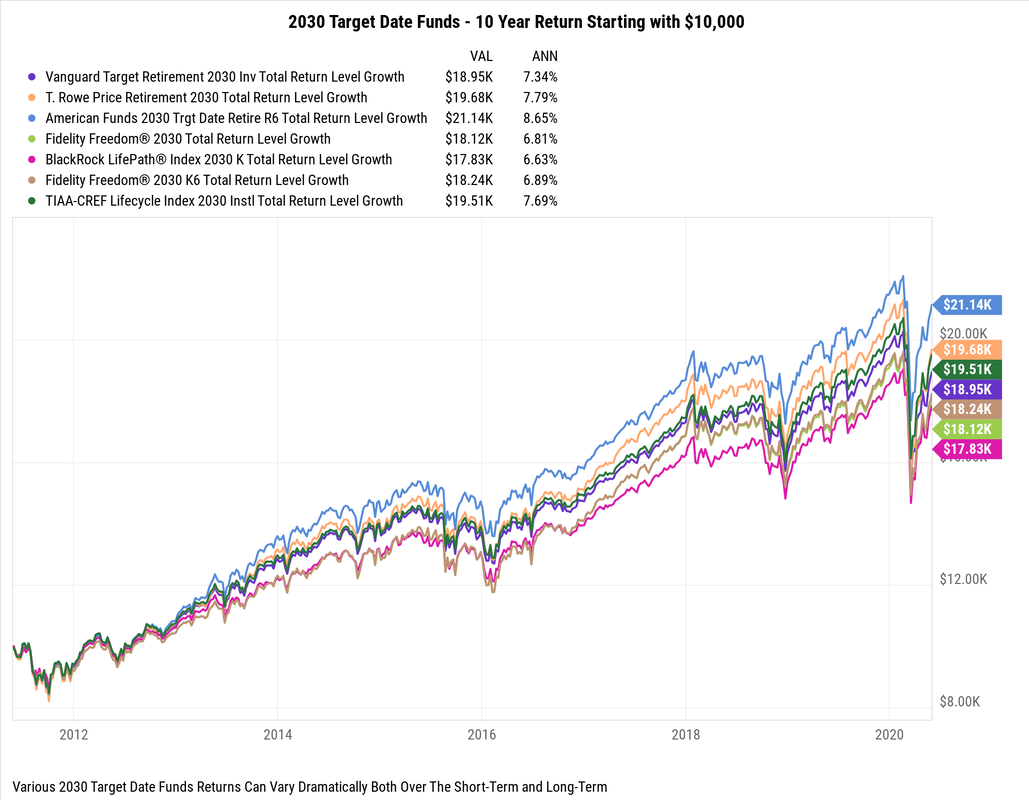

While Target Date Funds won't help answer the questions above, they can help people who at least want to get their retirement going and don't know where to start. Generally I agree that picking a Target Date Fund over the default money market option in most retirement plans is a pretty good start, but it’s definitely not the finish line, and quite honestly, it's closer to the starting line. Target Date Funds with the same target date have dramatically different returns over various time. Understanding how these target date funds are invested, what they’re invested in, how often they re-balance and the expenses they charged is critical to understand. Why? Well, this will determine how your portfolio will do overtime and how much money your portfolio may be worth in 10, 20, or 30 years in the future. Take a look at two charts below of many well-known Target Date Funds that all supposedly have the same retirement date. Notice the difference between returns and how volatile various target date funds can be even with the same retirement date of 2030. The below chart shows several 2030 Target Date Funds and how they faired during this recent downturn. They ranged from being down as little as -22% to down over -28% from their recent highs. The chart below shows the 10-Year return of these same seven 2030 Target Date Funds. The returns differences are staggering, if you had invested $100,000 10-year ago your value today would have ranged from $178,000 to over $211,000 depending which Target Date Fund you might have been invested in.  Having a well-though financial plan, understanding what you are invested in (research, research, research & more research), and recognizing not all Target Date Funds are created equal is important to meeting your financial goals.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |