|

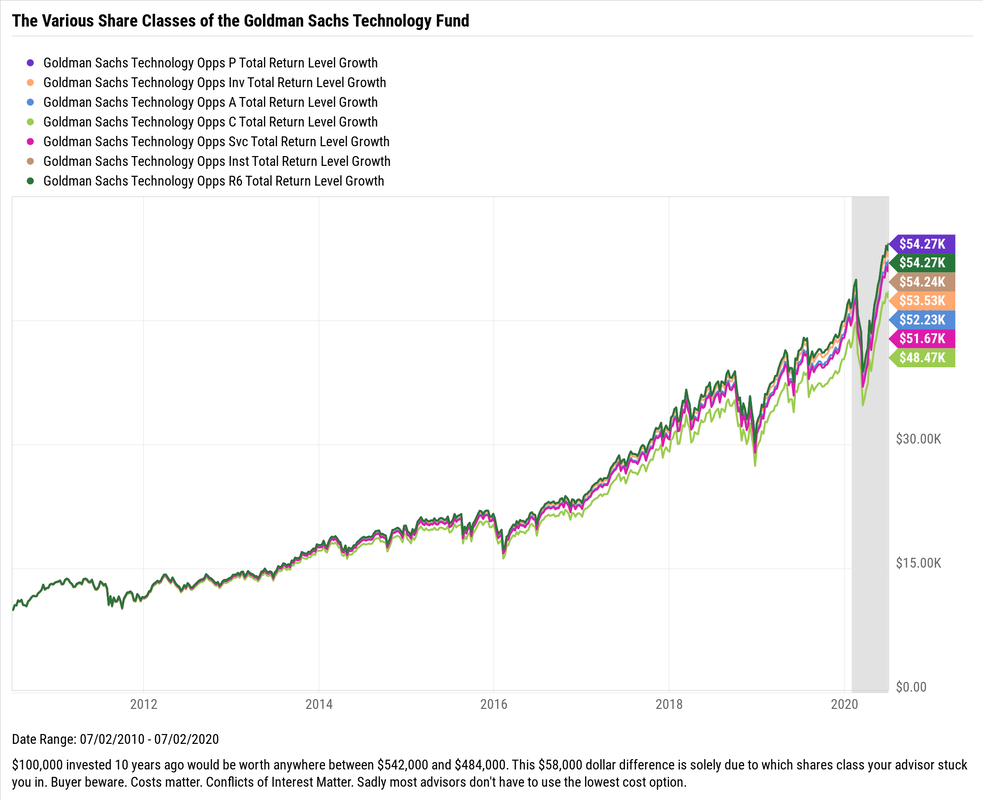

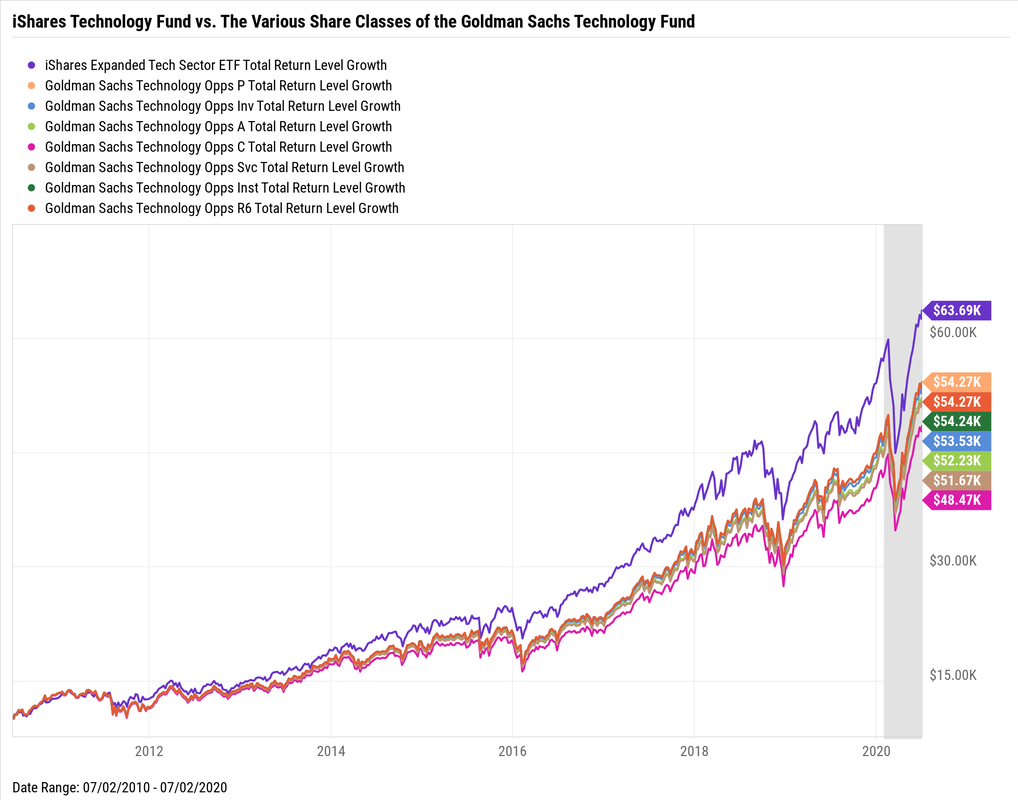

Most people have been accustomed to believing that the more you pay for something the higher the quality to be received. And in many areas of life, this is very well true. You can think of expensive German cars vs. less expensive domestic cars. Step into a high-end department store and get fitted for a custom suit vs. off the rack discount store and you can immediately "feel" the difference. From restaurants, autos, clothes, and electronics, the list goes on and on; pay more, and you can expect to receive a better product or service. Well confusing to most people, this idea does not hold true when it comes to investing. In fact, many times the opposite is true when it comes to investing. Of course the sales literature of the largest financial firms will beg to differ, and the allure of paying for more expensive investment products to get better performance will attract some. Regrettably most investors will not experience this outperformance, but they are guaranteed to experience paying more. The large financial firms that create and sell investment products have created mutual funds, which have by and large been a great benefit to individual investors. A mutual fund at the most basic level is a basket that is created to hold securities. By doing this, it provides diversification to investors by allowing people to buy a basket of securities at one time and removing the risk of owning individual securities (see risk of owning individual securities here). So far so good. Until we dig a bit deeper and get into what can be called the mutual fund share class zoo. These same companies who create these mutual funds, create different share classes that can be sold to different investors. The various share classes are broken down the following way: class A, class B, class C, class I, etc., basically a zoo of letters. These various share classes hold the exact same securities in their basket, so there is no difference in terms of holdings, expected return, and risk. The only difference between these various shares classes is how much money is charged and how much the company and it's advisors are going to make. The equation is simple, the more you pay the less you make and the more your advisor makes. It is essential to consider which class of mutual fund shares is suitable for you. I'll let you in on a secret, shhh, all else being equal, buy the lowest cost option. Below is a chart of the Goldman Sachs Technology Fund and all of it's various share class options. Again, the various mutual funds all hold exactly the same securities, the only difference is the amount of money being charged to own this fund. It's a dramatic difference between the lowest cost share class fund and the highest cost fund. $100,000 invested 10-years ago would be worth anywhere between $542,000 and $484,000. This $58,000 dollar difference is solely due to which shares class your advisor used. Costs matter. Conflicts of Interest Matter. Sadly most financial advisors don't have to use the lowest cost option as these financial advisors will make more money if they use the more expensive option. Yuk. Or if you really want to save money with essentially the same holdings and with historically better performance, the iShares Technology fund (IGM) is an option - see the purple line below. In fact, it's dramatically outperformed all of the Goldman Sachs Technology funds. Of course, past performance is no guarantee of future returns. While the technology sector has performed extremely well recently, I use this just as an example of the share classes (and the affect costs have on peformance) many of the large financial firms use and not necessarily promoting technology focused investments right now.

The example above used Goldman Sachs, but this holds true for all the other large financial firms: Morgan Stanley, Wells Fargo, JPMorgan, and Merrill Lynch (Bank of America), just to name a few. They are all guilty of promoting more expensive funds to investors who may not be aware of all the mutual fund share classes. Be careful, It's a zoo out there.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |