|

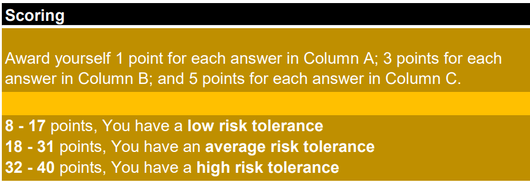

Does the thought of plowing money into a start-up company or buying shares of a company that recently went public excite you? Are you enticed by high-risk/high-return investments? Or do you prefer the "sure thing," believing that slow and steady can win a lot of races? If so, you might be considered a more risk-averse investor. There is no right or wrong type of investor, just what's right for you. Most people fall somewhere in between these two extremes. But knowing what your needs are, and what type of investor you are, can help get a sense of your risk tolerance and ultimately help you invest in a way that will build wealth over time. Like a finger print is unique to each individual, no two people will have the same views on investing. In less than 2 minutes, you can find out where you stand, are you a Tortoise or a Hare? Mark the responses below after each sentence that best describe your immediate reaction to each of the following statements. Try not to overthink your answers. Score yourself below. Drum roll please... Whatever your score, be it 8 or 40, or somewhere in between, knowing this number is critical to your investing success. Knowing your comfort level will go a long way in determining what type of investments are suitable for you and which ones are not. Investors would be wise to follow the ancient Greek aphorism "nosce te ipsum," more commonly known as "know thyself." -Paul R. Rossi, CFA For a deeper dive into your risk tolerance and to see if your investment/retirement portfolio is correctly aligned with who you are, click here.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |