|

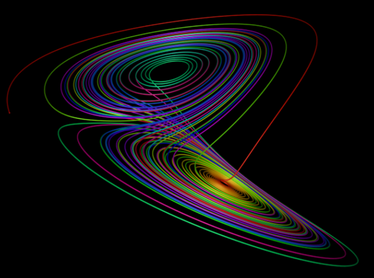

In physics, there is a well-known problem that is quite difficult, if not impossible. It’s called the three-body problem and is one of the most complicated in celestial mechanics. It’s the process of exactly solving for the motions of three bodies interacting through the inverse square force (gravity) – think of how the Sun, Earth, and Moon interact with each other. For centuries, physicists and mathematicians knew this problem is not integrable, i.e., we cannot find a precise analytical solution. What might be surprising though, physicists have solved the two-body problem. But by adding just one more body into the mix, the solution becomes impossible. Even though the three-body problem hasn’t been solved, how have we able to calculate the motion of all the planets in our solar system with such accuracy? Physicists reduce the three-body problem to something they can calculate, a more manageable two-body system. For example, although there are more than three bodies in the solar system (the Sun, eight planets, dozens of moons, and millions of asteroids and comets), almost everything behaves, roughly, as though it were a two-body system. Why? This is due to the substantial differences in mass between all the objects in our solar system. As far as each planet is concerned, the Sun is the primary influence due to its the sheer size. The Sun ‘pulls’ on the Earth about 200 times harder than the Moon, and about 20,000 times harder than Jupiter. So, if you want to calculate the orbits of all the planets, a “two-body approximation” will get you more than 99% of the way to the right answer. So what have we learned so far?

Using the idea physicists use to solve the three-body problem and what we have learned so far, I’d like to propose a similar thought about valuing high-growth companies. It’s a difficult process and a precise solution isn’t possible, but we should think of a solution being a range of possible valuations as there are many interactions (bodies) that affect valuation. The formula for a dividend paying company is fairly straight forward and therefore we can think of a dividend-paying company as a two-body problem which we can value much more reliably than non-dividend-paying companies. Unfortunately, many growth companies don’t pay dividends. Having said that, we can still get an “approximate” answer to our growth company problem, we just have to keep in mind that the solution should be a range of valuation possibilities rather than one precise "exact" answer. So let’s do it. To help determine if a company’s stock might be under-priced, fairly-priced, or over-priced, we can use some basic ideas of finance. One of these ideas is comparing a company to the overall market. Let’s use an example to drive home how this works: We want to figure out if AMZN (Amazon) is potentially under-valued, fairly-valued, or over-valued. Using recent financial information, we see that AMZN’s PE ratio is 64. (PE = Price per Share / Earnings per Share). Essentially, how much are investors paying for every $1 dollar of earnings. In this case, new investors are paying $64 for every $1 of AMZN earnings. AMZN’s PE ratio of 64 is substantially higher than the current market PE of 25. It’s a staggering 256% higher. What does this mean? This means that new buyers of AMZN are paying 256% more for every dollar of earnings than the average company within the S&P 500. The next question should be, why is AMZN trading at a price so much higher than the market and is this justified? Let’s find out. Some Assumptions: AMZN PE = 64 Stock Market PE = 25 Growth Rate of AMZN = 20% Growth Rate of Stock Market = 7% Dividend Yield of AMZN = 0% Dividend Yield of Stock Market = 2% T = Time in Years of Required AMZN growth to justify current valuation The formula is below (#1), and (#2 - 7) is the calculation:

So based upon these calculations we find that AMZN would need to grow at 20% a year for the next 9.95 years and then grow at the lower overall market growth rate in perpetuity to justify its current PE ratio of 64. So the question becomes, do you think Amazon can continue to grow at 20% a year for the next 10 years? If so, then its current valuation seems appropriate. If you think Amazon will grow faster than 20% or for longer than 10 years, it could be considered undervalued. Conversely, if growth doesn’t materialize or is substantially shorter than 10 years, then the current valuation isn’t justified. Like the dreaded three-body physics problem, valuing growth companies isn't easy, but it can be done with approximation. -Paul R. Rossi, CFA

1 Comment

Erik Johnson

11/2/2021 07:10:32 pm

I found it was very interesting after our meeting how much of this I understood, I didn’t realize I retain that much information from speaking the other day. I also understand how important it is to know the valuation companies which you are purchasing stocks in. Great information, thanks Paul

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

||||||