|

Consumer spending is the backbone of the U.S. economy, constituting over two-thirds of our nearly $28 trillion GDP. When consumers spend money on everyday goods and services, and make large one-time purchases, it not only helps to spur economic growth but is also a reflection of economic trends. This is because many factors affect consumer purchases, things like:

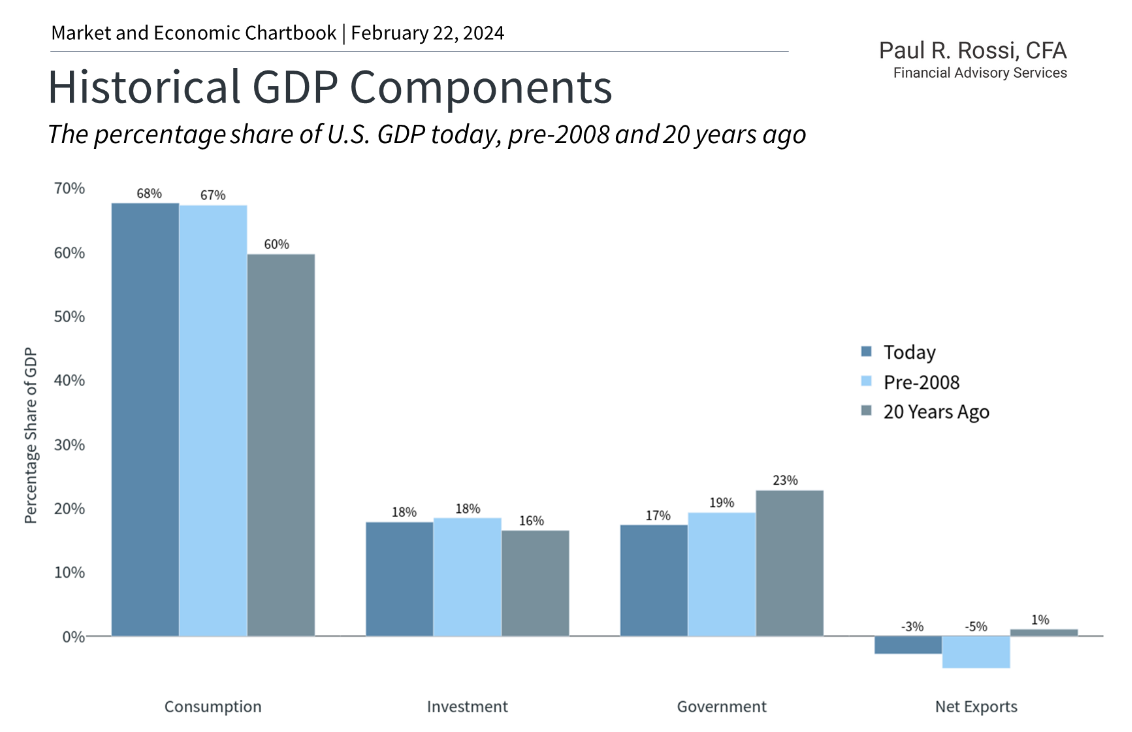

Many factors play a role in consumer behavior which affects the economy and in turn influence the stock market, bond market, commodities market, real estate market, and others. What do investors need to know about the state of the consumer and how it might affect the economy and stock market in the coming year? Of the various components of GDP, (click here for a in depth breakdown of GDP) consumer spending has been the most stable and in fact growing, while over the past decade government spending is down. The strength of the consumer has helped the economy stay out of recession despite higher inflation rates, layoffs in the tech sector, and ongoing uncertainty. In turn, this has helped to propel the stock market to new all-time highs. While consumer spending has a direct impact on economic growth, how everyday consumers feel about the economy can vary dramatically over time. Perhaps the best example is the decade following the 2008 global financial crisis. Consumer sentiment was poor for many years due to a weak job market. The housing bust and a sharp decline in manufacturing activity led many to give up on finding work, resulting in a falling labor force participation rate. Even when the overall economy was recovering, consumers were pessimistic. The fact that housing prices collapsed, and it took the stock market almost 6 years to recover also led to lower consumer confidence. In many ways, the situation today is the opposite of the post-2008 period. Despite fears of economic weakness, the unemployment rate is still at a historically low 3.7%, 353,000 jobs were added in January, wages have risen over 4% during the past year, and there are still nine million job openings across the country. The fact that the stock market is near all-time highs has also helped to boost the "wealth effect" among consumers. While the housing market still faces many challenges with 30-year mortgage rates above 6%, transactions that do occur are closing at relatively high prices. What's the bottom line? Despite some headwinds, consumers are increasingly optimistic as inflation improves and the job market remains strong. While there are still challenges ahead, consumer spending continues to support the economy and the stock market. The bottom line is the consumer will determine our path forward. -Paul R. Rossi, CFA

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |