The Tortoise or the Hare...What's Your Investment Style?

02/13/2021

Does the thought of plowing money into a start-up company or buying shares of a company that recently went public excite you? Are you enticed by high-risk/high-return investments? Or do you prefer the "sure thing," believing that slow and steady can win a lot of races? If so, you might be considered a more risk-averse investor.

There is no right or wrong type of investor, just what's right for you. Most people fall somewhere in between these two extremes. But knowing what your needs are, and what type of investor you are, can help get a sense of your risk tolerance and ultimately help you invest in a way that will build wealth over time.

Like a finger print is unique to each individual, no two people will have the same views on investing.

Click here to read entire article.

02/13/2021

Does the thought of plowing money into a start-up company or buying shares of a company that recently went public excite you? Are you enticed by high-risk/high-return investments? Or do you prefer the "sure thing," believing that slow and steady can win a lot of races? If so, you might be considered a more risk-averse investor.

There is no right or wrong type of investor, just what's right for you. Most people fall somewhere in between these two extremes. But knowing what your needs are, and what type of investor you are, can help get a sense of your risk tolerance and ultimately help you invest in a way that will build wealth over time.

Like a finger print is unique to each individual, no two people will have the same views on investing.

Click here to read entire article.

The Law of Gravity in Finance

02/12/2021

One of the fundamental laws of the universe, is the Law of Gravity. Einstein taught us that gravity is the bending of space/time, which we perceive as objects being drawn toward each other.

Finance's "Law of Gravity" is the idea of the relationship between risk and return. The idea is pretty straight forward: The riskier the investment, the potential greater the return. Said another way, the lower the risk, the lower the expected return. The relationship between risk and return is positivity correlated, therefore the more an investor is willing to dial up their risk, the more return they expect to make.

Click here to read entire article.

02/12/2021

One of the fundamental laws of the universe, is the Law of Gravity. Einstein taught us that gravity is the bending of space/time, which we perceive as objects being drawn toward each other.

Finance's "Law of Gravity" is the idea of the relationship between risk and return. The idea is pretty straight forward: The riskier the investment, the potential greater the return. Said another way, the lower the risk, the lower the expected return. The relationship between risk and return is positivity correlated, therefore the more an investor is willing to dial up their risk, the more return they expect to make.

Click here to read entire article.

A Tale of Two Investors

02/03/2021

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way.” – Charles Dickens, the famous opening quote from the 1859 book, A Tale of Two Cities.

At one point, A Tale of Two Cities was cited as the best-selling novel of all time. Dickens was a champion of the poor in his writings and in his life as he became the most popular novelist of his time. Astoundingly, his works have never gone out of print.

Click here to read entire article.

02/03/2021

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way.” – Charles Dickens, the famous opening quote from the 1859 book, A Tale of Two Cities.

At one point, A Tale of Two Cities was cited as the best-selling novel of all time. Dickens was a champion of the poor in his writings and in his life as he became the most popular novelist of his time. Astoundingly, his works have never gone out of print.

Click here to read entire article.

|

PE, PEG, Beta...What Does That Mean?

01/17/2021 The financial services industry and in particularly the investment and portfolio management sub-field has a quite a few industry specific terms. As a group, financial professionals tend to think most people who are not in our industry understand many of terms we use so freely - which of course isn't necessarily true. So I've attached a link to a great resource of financial glossary terms provided by YCharts.com. Click here to read entire article. |

Top 10 Predictions for 2021

01/12/2021 So, it’s that time of year (again). In the spirit of making predictions that will actually come true, here are our Top 10 predictions in order of certainty. In other words, Prediction #10 is pretty-darn-certain to happen while Prediction #1 is absolutely guaranteed. #10. Stock Market Volatility Will Continue The stock market, the bond market, the commodities markets, the geopolitical landscape, pretty much all endeavors where people are involved are volatile – some more than others. This is a feature not a bug. Click here to read entire article. |

|

MIke Tyson and Your Financial Plan

12/29/2020 Mike Tyson famously said, “Everyone has a plan until they get punched in the mouth.” The brutal “punch in the mouth” brought on by Covid-19 caused markets worldwide to collapse and the repercussions sent shock waves throughout our daily lives. It’s changed how we work, learn, shop, eat, interact and generally how we live. Click here to read entire article. |

Are IPO's Right For You

12/23/2020 What is an IPO? An IPO (Initial Public Offering) is when a private company transitions from being a private company to public company and it's at this point in time that Joe and Jane public can for the first time invest and own shares of the company. By nature, IPOs are risky. Why? Well investors have relatively limited financial history on the company going public. Why? Click here to read entire article |

|

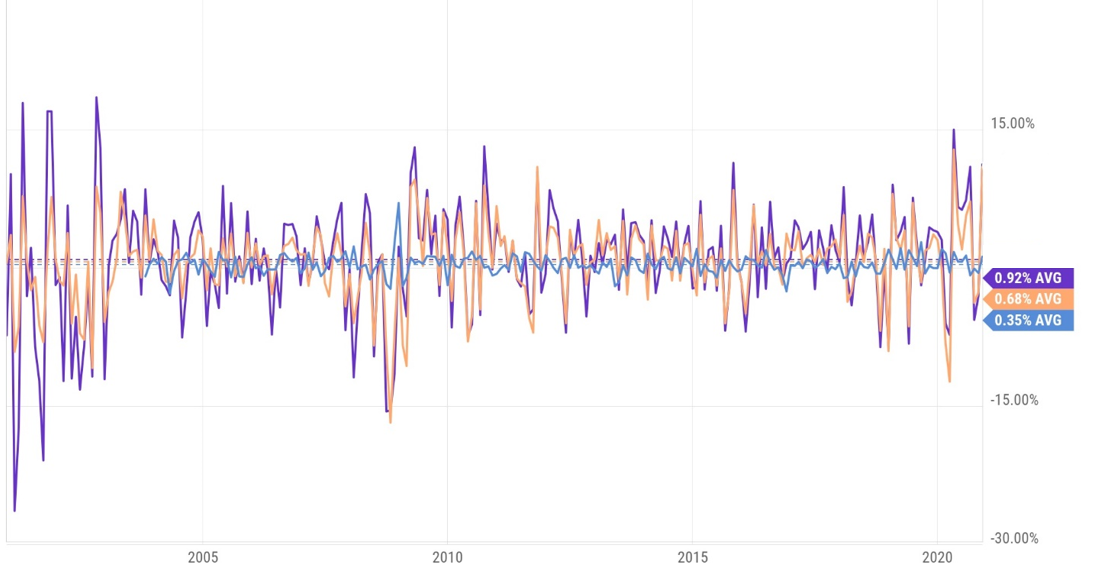

Another Way to Look at Volatility

12/20/2020 The Stock Market is Volatile. It's volatile on a daily basis. It's volatile on a monthly basis. And it's volatile on a yearly basis. Take a look at the first two charts below which show the 20-year period of monthly and yearly returns respectively for:

Click here to read entire article. |

Much to be Thankful For

11/24/2020 I'm thankful for so many things in my life, that sometimes I feel I've won the lottery. Why do I say this? Because it's true. First, let's start with family: I have a great relationship with my wife and children that I feel very fortunate. I'll admit, I'm very intentional in how I communicate and interact with my family and don't take it for granted. While 2020 has been an extremely challenging year for so many people, I feel very fortunate because it's allowed some very positive things to come out of an extremely challenging period - and I believe many times challenging situations can provide positive growth, sometimes in truly unexpected ways. Second, my clients and friends: Click here to read entire article. |

|

The Stock Market Can Feel Like Gambling

11/21/2020 I've heard many people over the years express their concern that investing in the stock market feels like gambling - where there is little chance of winning. The remark typically sounds something like this, “The market goes up and then it goes down and you don't make money, it feels like gambling.” So I decided to see if there is some validity to this belief. Click here to read entire article. |

Working with an Independent Registered Investment Advisor vs. a Wall Street Firm

11/19/2020 Investors with complex needs are increasingly seeking out independent advice—and one way to ensure you’re getting independent advice is to work with an independent financial advisor. Sounds pretty straight forward, if you want independent advice, then seek out firms that are independent. So what are 5 benefits of working with an independent financial advisor? Click here to read entire article |

|

Fear, Greed, and First Principals

11/10/2020 In the short-term the markets trade on greed and fear, but in the medium to long-term, they trade on First Principles. What are First Principles? Before we get to that, let us understand what greed and fear are as it relates to investing. Greed is the idea of not wanting to lose out on an opportunity to make money especially when you see others around you making what seems like easy money. Click here to read entire article. |

The Science of Rebalancing As We Close Out 2020

11/04/2020 Annual rebalancing can help boost returns and reduce your volatility. As 2020 wraps up, it’s time for investors to start thinking about rebalancing their portfolio(s). And while it is important to examine rebalancing every year, it can be especially important this year due to the large return differences in asset classes. For example, through early November 2020, looking at the variability of returns from different sectors and market indices is quite dramatic. Click here to read entire article. |

|

4 Tips For Your Wealth and Sanity

10/27/2020 Investing can be stressful, but it doesn’t have to be. If you have a well-built portfolio, understand what you own, and have a plan, then you shouldn’t be too worried about market volatility and what the financial pundits are saying. Here are a few tips to help you invest wisely and stay sane at the same time. Click here to read entire article. |

5 Distinct Benefits of Working With a Registered Investment Advisor

10/13/2020 First, let's ask, what is a Registered Investment Advisor? And what makes this advisor different from a Registered Representative who works at my bank or a national brokerage firm? - A lot actually, keep reading. Click here to read entire article. |

|

The Dangers of Trying to Time the Stock Market

10/12/2020 Are you considered clairvoyant? Do you win an office football pool every year? Can you accurately and consistently predict 10 coin flips in a row? Are you a palm reader? Are you the sort of person who, while possessing no psychic abilities, does not mind spending hours crunching numbers and analyzing obscure data in hopes of discerning future trends? If you failed to answer yes to any of these questions, then market timing may not be for you. The belief that you, or any particularly person, can foresee the direction of the stock market is a seductive one. Click here to read entire article. |

Understanding the Dow

10/01/2020 Television and radio business news reports lead with it almost daily. Serious financial discussions begin with it. Many economic discussions are often centered on it. The “it,” is the “Dow,” or more accurately, the Dow Jones Industrial Average, and it remains the most widely used measure of stock market performance by many main street pundits. So what exactly is the Dow Jones Industrial Average? Click here to read entire article |

|

Take Advantage of Bear Markets

09/17/2020 The real value of a bear market may be that it gives investors, who are temporarily frozen within its grip, the opportunity to learn or relearn important lessons regarding risk and diversification. For savvy investors, a bear market also creates a period for looking beyond emotional headlines and studying the hard facts—facts that can ultimately place them in a position to take advantage of coming opportunities. Periods of falling equity prices are a natural part of investing in the stock market. Bear markets follow bull markets, and vice versa. They are considered the “ebb and flow” of wealth accumulation. Click here to read entire article. |

The Stock Market Is Not The Economy

09/01/2020 Over the last 152 years, from 1869 to 2020 the U.S. has experienced 31 recessions (including the current recession), for a total of 43.8 years of economic contraction. And on average each recession lasted 17 months. Conversely, there have been 32 periods of expansion economic activity totaling over 108.2 years, with each one averaging 3.3 years. So, said another way, 71% of the time we are in an expansive economy and 29% we are in a contracting economy. What is surprising, of these 31 recessions, 54% (17) of the time, the stock market actually went up. How is this possible? Because the stock market is not the economy. Click here to read entire article. |

|

Guideline For Investing at Record Market Highs

08/26/2020 Investing principles to provide you comfort during exuberant markets.

Your biggest question: How do you keep your head during what is an unprecedented time. It might seem the stock market and the economy are not reading the same news. There’s an effective medium, though, between doing nothing and panicky trading. These guidelines can keep you level-headed even while the markets twist and turn and record new highs. Click here to read entire article. |

How To Get Dropped From the Dow Jones Industrial Average

08/25/2020 Exxon Mobile has been a part of the part of the Dow Jones Industrial Average in one form or another since 1928. It's one of the largest oil companies in the world and for 92 years was considered a stalwart. In 1994 Exxon was valued at over $446 billion dollars and was the most valuable company in the United States. At one point, even Warren Buffett owned the stock. From 1994 - 2013 Exxon generated an annualized return of 12.65%, a whopping total return of 985% return during this 20-year period. Exxon's performance completely dwarfed the overall stock markets total return of 471%. What could go wrong? Click here to read entire article. |

|

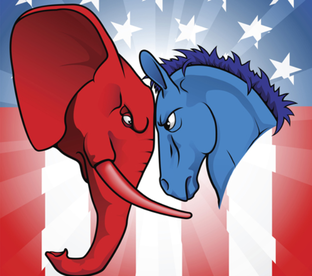

The US Presidential Election and Its Implications on Investing

08/22/2020 As we get closer to the US Presidential election, the chatter begins to build about who may or may not occupy the White House, which in turn leads investors to worry about how this might impact the stock market. I’d like to provide some information and historical perspective. For years now, politics and investing have been spoken about in the same breath. Market pundits and even presidents themselves have linked the performance of the stock market as a sort of “barometer” of their administration’s policies. What's interesting, the data doesn’t support this connection. Click here to read entire article. |

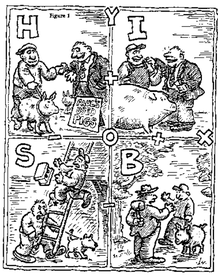

The 5 Basic Laws of Human Stupidity

08/14/2020 The First Law of Human Stupidity The first basic law of human stupidity asserts without ambiguity that:

At first, the statement sounds trivial, vague and horribly ungenerous. Closer scrutiny will however reveal its realistic veracity. No matter how high are one's estimates of human stupidity, one is repeatedly and recurrently startled by the fact that: Click here to read entire article. |

|

How to Leave a $1 Million Legacy to Your Children or Grandchildren With Only $10,000.

08/12/2020 Many people would like to leave a legacy to the children or grandchildren but aren't quite sure how to do it, they don't know the best way to go about doing it, or might not have a substantial amount of money set aside to be able to feel like they can make an impact. There is a novel solution we've come up with that provides several key benefits: So what is this strategy? Click here to read the entire article. |

Economic Update - A Closer Look at Q2 2020 Data

07/29/2020 Stock markets around the world rallied in the second quarter of 2020, recouping much of the ground lost in the first quarter of the year as the Coronavirus pandemic shook the overall economy and dominated headlines. The tech dominated Nasdaq Composite Index returned to all-time high territory in June while the S&P 500 and Dow 30 ended the quarter 7% and 11% off previous highs respectively. The strong stock market amidst all the uncertainty in the economy has been a head-scratcher for many. Below we’ll look at the performance of different sectors, several asset classes, some leading and lagging economic indicators, and some of the government policy that has been implemented – all of which may help to shed some light on these confusing times. Click here to read entire article. |

|

Earning A Clients Trust

07/15/2020 What does it take for someone to put their capital at risk and entrust their funds to someone else to manage? Trust is a multi-layered concept, and it is essential to the proper functioning of capital markets. Without it, financial interactions would become more inefficient and costly or cease altogether. In this fourth edition of the CFA Institute investor trust study, we examine how trust in the industry has evolved, while the essential characteristics of trust endure. Click here to read entire article. |

There Is Always A Reason Not To Invest

07/07/2020 Over the years, we've all heard the doom and gloom from all sorts of so-called market experts. Here's a very short list of some of what you might have heard:

Doom and gloom sound bites make headlines, help sell complex expensive investment products and fit nicely in the 240 character limit on Twitter. But other than that, most of the time they aren't good for much, except for creating fear. Click here to read entire article. |

|

The Share Class Conflict, It's a Zoo

07/06/2020 Most people have been accustomed to believing that the more you pay for something the higher the quality to be received. And in many areas of life, this is very well true. You can think of expensive German cars vs. less expensive domestic cars. Step into a high-end department store and get fitted for a custom suit vs. off the rack discount store and you can immediately "feel" the difference. From restaurants, autos, clothes, and electronics, the list goes on and on; pay more, and you can expect to receive a better product or service. Click here to read entire article. |

The Risk of Owning Individual Stocks Is Real

06/22/2020 There is a reason why the vast majority of individual investors shouldn't own individual stocks. Lots and lots of companies don't do well, in fact, many can make horrible investments and some even go out of business. Below is a 5-Year Chart of the 11 Worst Performing Stocks in the S&P 500 - while many other companies lost money over this same time period, in fact, 145 were money losers over the last 5-years. Or said another way, almost 1/3 of all companies in the S&P 500 index lost money over the last 5-years! Click here to read entire article |

|

Top 10 Predictions for 2020 - Ranked from Pretty Darn Sure Certain to Absolutely Guaranteed

06/06/2020 So, in the spirit of making predictions that will actually come true, here are my Top 10 predictions in order of certainty. In other words, Prediction #10 is pretty-darn-certain to happen while Prediction #1 is absolutely guaranteed. #10. Volatility will remain The stock market, the bond market, the commodities markets, the geopolitical landscape, pretty much all endeavors where people are involved are volatile – some more than others. This is a feature not a bug. Click here to read entire article. |

The Corona Bear Market and It's Place In History

06/06/2020 The Coronavirus Bear kicked the 11-year Bull Market of Wall Street very fast. A “bear market” occurs when stock prices in general are falling, and then widespread pessimism sustains the continued drop in prices. The stock market becomes a bear market whenever stock prices have fallen over 20% over the course of several months, as seen in market indexes like the S&P 500. Investors lose confidence in the market as they anticipate further losses. A “bull market”, on the other hand, comes with rising stock prices and increasing investor confidence. Stock prices rise by at least 20% over the course of several months in a bull market. Looking at history, bear markets are typically shorter than bull markets. A bull market's average duration is about 3 years, while bear markets last on average about 18 months. Click here to read entire article. |

|

Not all Target Date Funds Are Created Equal

06/02/2020 Target Date Funds have become wildly popular in retirement plans over the last few years, and rightfully so, they help investors who don’t necessarily have a great understanding of investing or don’t have the time, the commitment, nor the energy to put toward researching and understanding how they should be invested. What is a Target Date Fund? It's a prebuilt portfolio that uses one input to determine how to invest your money. What's the one input? Click here to read entire article. |

IQ, Einstein & Your Investing Success

05/25/2020 "The unfortunate truth is that intelligence and experience in one domain do no necessarily translate to another domain. More importantly, IQ tests do not assess whether a person is rational. Someone can have a very high IQ and yet not be very rational. A high-IQ individual may also not have well developed skills, such as judgment and decision making." - Tren Griffin. In fact, having a high-IQ may lead to over-confidence and not understanding where your circle of competence ends. "A lot of people with high IQ's are terrible investors because they've got terrible temperaments." - Charlie Munger, Vice-Chairman of Berkshire Hathaway. Charlie also said, "Very-high-IQ people can be completely useless-and many of them are." Click here to read entire article. |

|

Warren Buffett and Berkshire's 2020 Annual Meeting

05/23/2020 Never bet against America and more sage advice from the Oracle of Omaha Warren Buffett, one of the most successful and admired investors of our time, held the 2020 Berkshire Hathaway Annual Meeting of Shareholders from the company’s Omaha, Nebraska headquarters on the first Saturday of May. The Berkshire Annual Meeting, which has become an annual Woodstock-like event for investors around the world, drew a record 40,000 visitors last year, but this year (2020) the event was live-streamed instead due to COVID-19. And the Meeting was also limited to 89 year old Buffett holding court without his 96-year old friend and colleague Charlie Munger, who did not attend given the stay-at-home orders. Click here to read entire article. |

8 Things You Must Know About Medicare

05/23/2020 Heading into your retirement years brings a slew of new topics to grapple with, one of the most confusing may be Medicare. Figuring out when to enroll, what to enroll in and what coverage will be best for you can be daunting. To help you wade easily into the waters, here are 8 essential things you need to know about Medicare. Medicare Comes with a Cost Medicare is divided into parts. Part A, which pays for hospital services, is free if either you or your spouse paid Medicare payroll taxes for at least ten years. (People who aren't eligible for free Part A can pay a monthly premium of several hundred dollars.) Part B covers doctor visits and outpatient services, and it comes with a monthly price tag. Click here to read entire article. |

|

Inflation, Purchasing Power, and Your Retirement

05/22/2020 You hear it all the time: you should make sure your retirement savings at least keep pace with inflation. But what is Inflation and how does it really affect your retirement savings? Let’s explore. In simple terms, Inflation is an increase in the general level of prices for goods and services. Deflation, on the other hand, is defined as a decrease in the general level of prices for goods and services. Click here to read entire article. |

10 Rules For Forecasting

05/13/2020 The nice thing about being an investor is that the forces that drive the markets change all the time. However, there are different “market regimes” in which a major narrative dominates market action. Over the last 20 years of my career, there have been several ascendant market narratives: technology companies revolutionizing the world, followed by the “jobless recovery” of the early 2000's, and then the “Great Moderation” a few years later. Suddenly in 2007, we all had to become experts in housing and mortgage markets as subprime mortgages blew up the world. Then it was back to central bankers and such unconventional monetary policy as quantitative easing (QE) and “Operation Twist” that created a “new normal.” Then came the European debt crisis and austerity, which was replaced in recent years by geopolitics and the rise of populism. |

|

Just Do It

05/03/2020 Just Plan Critical for long-term success, your financial plan doesn't need to be complicated, but it should provide a starting point and create a baseline for measuring your goals and determining what’s most important to you. Just Cut Fees Physically review all financial statements (bank, brokerage, retirement, etc.), bills (home & auto insurances, utility, etc.), and subscription services (gym memberships, streaming services, internet providers, phone contracts, etc.) to uncover fees that you can eliminate or reduce. There's no excuse not to now...most of us are at working from home due to COVID-19. Find the time to spend just a few minutes which could end up saving you hundreds if not thousands of dollars every year. Click here to read entire article. |

Best Questions To Ask When Interviewing a Financial Advisor

04/29/2020 One of the first steps to choosing the right manager for your wealth is knowing the right questions to ask. And knowing the right answers to see if they measure up to your financial goals. How long have you worked with high-net-worth individuals, and in what capacities? Although private wealth advisers often find working with high-net-worth investors to be satisfying, other career paths can offer insights about the technical knowledge required for client success. What training did you undertake to prepare for this role? Some larger firms offer specialized training courses, while practitioners elsewhere may enroll in classes or degree programs to prepare themselves. Click here to read entire article. |

|

The Current Bear Market

04/28/2020 The pace with which the Coronavirus bear toppled the longest-running bull market in history was startling. The Dow Jones Industrial Average officially entered the “Coronavirus bear market” in just 20 trading days, easily making it the fastest such slide in stock market history. The second fastest was 1929 and that took 36 trading days. Lest we forget: the highest closing record for the DJIA was set on February 12, 2020, when it closed at 29,551.42. Less than one month later, on March 11th, the DJIA closed at 23,553.22, down 20.3% from its high and officially ending the longest-running bull market in history that started in March 2009. Click here to read entire article. |

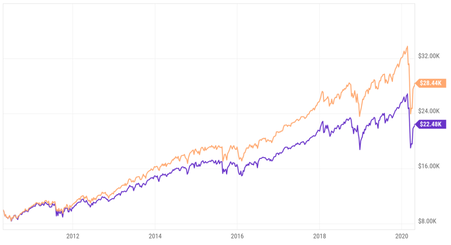

S&P 500 Index Fund vs. S&P 500 Index Fund

04/25/2020 What's the difference between these two S&P 500 index funds?

So what might cause their dramatic difference in performance over the last decade? Simply, the amount of money they charge investors. The industry calls this fee their "expense ratio." Click here to read entire article. |

|

Many Investment Products Are Not What They Claim

04/23/2020 Many investors and for that matter many Financial Advisors don't understand what they are actually investing in when they pick a particular investment fund. Many unsuspecting investors look at the name of the fund, do a quick glance at the historical performance and hit the "buy" button without fully vetting what the fund is actually invested in. For many investors the process I just laid out is what they call "research", but in truth it's nothing more than window shopping. Buyer beware. Click here to read entire article. |

Risk Goes Down Over Time

04/17/2020 Depending on the time frame you are referencing, the Stock Market return has been great, horrible or something in between. It's important to understand, time can be considered a diversifier similar to diversifying across different assets and securities. Being invested across many different types of securities and across several asset classes is akin to using time to reduce risk, risk goes down with time. It's important to keep Stock Market returns and Time in perspective. Click here to read entire article. |

|

8 Tips to Dramatically Improve Your Retirement Portfolio Right Now

04/15/2020 “The worst thing mistake you can make in investing is to buy or sell based on current headlines.” - Warren Buffett During these challenging times, it's actually a great opportunity to review your Retirement Portfolio and your overall Financial Plan. There are some amazing opportunities to take advantage of what the market is providing long-term investors. With more people working from home right now, you might have some extra time to dig up a recent statement and make sure you are on track to meet your financial goals. Here are 8 quick ideas to help improve your Retirement Portfolio. Click here to read entire article. |

Economic Forecasting, The Fed, and Your Financial Plan

04/13/2020 When weather forecasts are inaccurate, we can usually change our plans with little consequence in the greater scheme of things. While making financial decisions does involve some guesswork, an educated guess—even with elements of uncertainty—sometimes can be better than making a decision with no forecast at all. Unfortunately, economic forecasting, like weather forecasting, is far from an exact science. Even professional economists may strongly disagree on the direction of the economy at any given point in time, based on their interpretations of conflicting economic indicators. Although many factors are pivotal in assessing the economy, let’s focus on two key points that may help you better understand the economy, and where it may be headed in the near future. Click here to read entire article. |

|

Doing Nothing - The Superpower of Successful Investors

03/31/2020 Do nothing. Huh?...I repeat. Do nothing. What? Our whole lives we have been told and our own experience shows us by working hard, getting good grades, keeping busy, and pushing forward is almost a sure bet to getting ahead and grabbing the brass ring. Click here to read entire article. |

Buy American. I Am.

03/11/2020 Below is a letter that Warren Buffett penned in THE NEW YORK TIMES during what would become known as the Global Financial Crisis. During these turbulent times, I think it's important to re-read what he wrote, it's sage advice for investors. By WARREN E. BUFFETT OCT. 16, 2008 THE financial world is a mess, both in the United States and abroad. Its problems, moreover, have been leaking into the general economy, and the leaks are now turning into a gusher. In the near term, unemployment will rise, business activity will falter and headlines will continue to be scary. Click here to read entire article. |

|

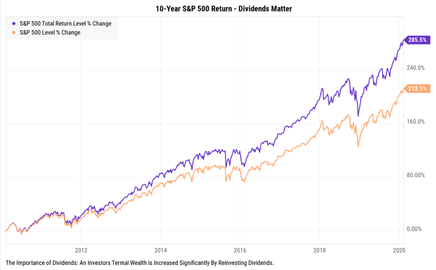

Dividends Matter

02/10/2020 Over the last 10-years the S&P 500 or what many people refer to as the "Stock Market" is up over 285% when factoring in reinvested dividends (purple line). While it's not mentioned a lot in the news, the dividends paid by these companies has a dramatic impact on investors and their overall return. In the chart above, you'll notice the same index (in orange) shows the index return excluding dividends. The return difference is material. Dividends Matter. |

Ultimate Tips For Homebuyers

01/02/2020 My firm was recently approached by the leading online Real Estate firm Redfin to provide a very short tip that could help potential homebuyers save for a home. Redfin asked myself and several advisors around the country for their advice. Collectively, there is some great advice for would be homebuyers as well as helping give people some financial direction. Here is the beginning of Redfin's article: Are you a millennial thinking about settling down and buying your first home? Click here to entire article. |